Each generation of workers has their own financial wellness priorities as they move through different chapters of life. And while employers can’t guarantee that the benefits they offer will address the specific needs of every individual employee, they can implement offerings that are impactful for every generation. To do this, employers need to first understand what’s important to employees, rather than assuming their priorities.

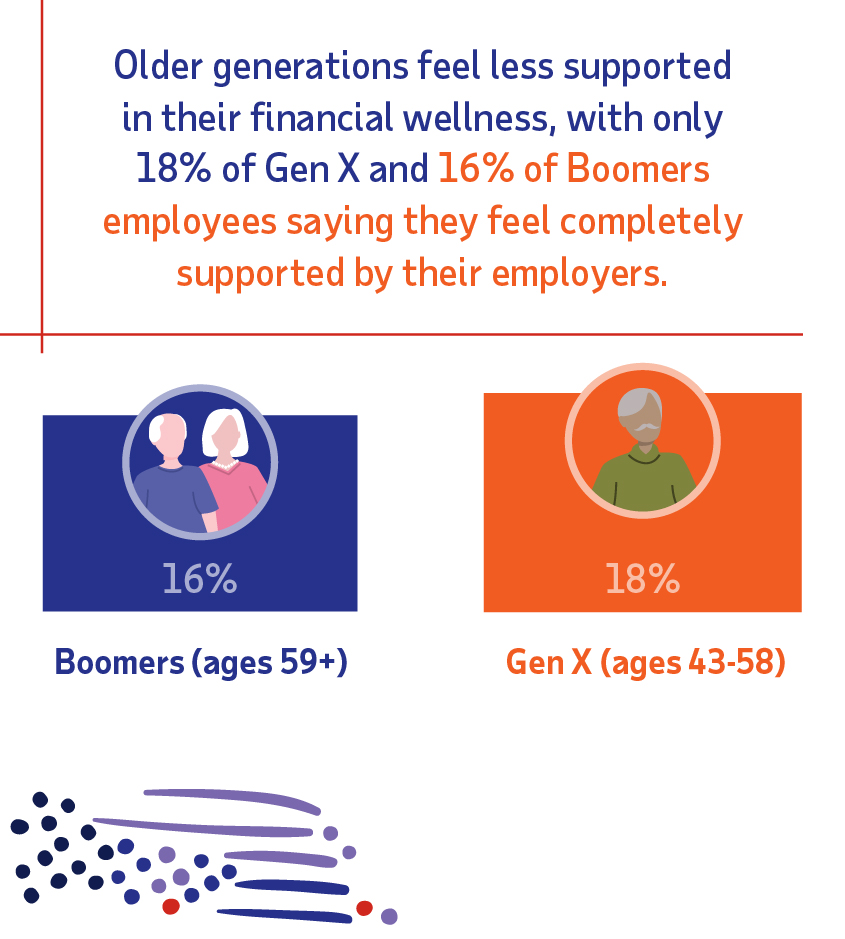

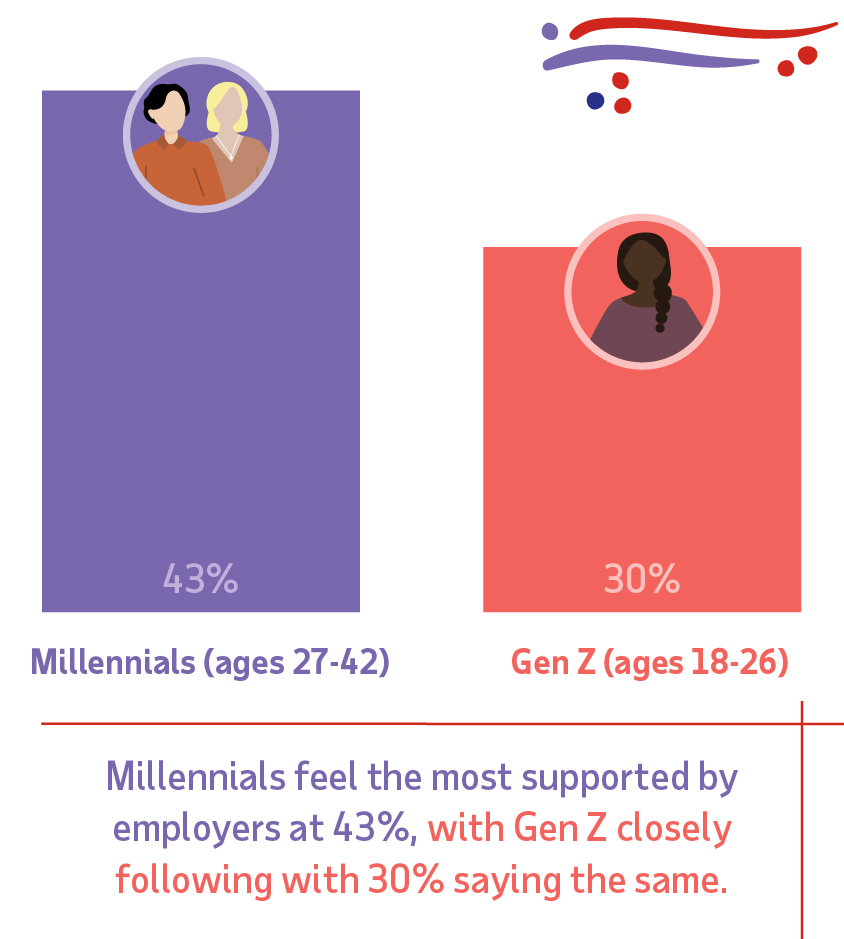

The importance of this can’t be overstated, especially when 49% of employers believe they’re in complete support of their employees’ financial wellness — but only 28% of employees feel the same1. There’s a clear disconnect between employers and employees on financial wellness support, and one that varies even more so across generations.

According to Payroll Integrations’ 2024 State of Employee Financial Wellness Report1

Employers need to consider the needs of every generation when developing and investing in employee benefits and financial wellness programs. At different stages of life, it’s no surprise that employees have different priorities, but employers need to not merely guess at what’s important — they need to know by having conversations with employees.

Here are some ways employers can ensure their benefits and financial wellness programs are addressing employees’ needs:

Invest in the benefits employees care about

With the right knowledge, employers can make strategic investments to improve employee financial wellness and do it effectively across generations. For example, despite their generation, all workers name healthcare (72%) and retirement (73%) as the two benefits most important to their financial wellness. The benefits that employees rank next vary across generations.

- 44% of Boomers rank retirement plans as their next most valued benefit; and

- 46% of Gen X workers say additional compensation like bonuses and stock options are most important.1

Older generations are prioritizing their long-term savings, while Gen Z and millennials are particularly focused on benefits that prioritize their lifestyles and impact their overall cost of living. While millennials are looking for health savings accounts amidst rising healthcare costs and deductibles, Gen Z employees say lifestyle compensation benefits are a top priority, including reimbursements for commuting and wellness.

With insight into the financial wellness needs of each generation, employers can prioritize the programs that are most important to employees. This allows employers to focus their investments on the benefits and programs that they know employees will actually use, instead of trying to offer a bit of everything. Employers may even be able minimize investments in some benefits if they’re not of interest to employees.

Consider prospective employees as part of benefit planning

It’s critical that employers make benefits and financial wellness decisions based on the needs of their current employees to retain their top talent. However, they should also consider the needs of prospective employees, and how they can keep their offerings competitive in the market.

Employers should be especially tuned into Gen Z, the newest addition to the workforce. They’re more mobile, plugged in, and informed — and also the most in need of boosted financial wellness. Attracting the best talent often means attracting some of the youngest professionals. Beyond retirement and health insurance, Gen Z workers say their top reasons to not accept a job are a lack of student loan/tuition payment assistance (27%), life insurance support (27%) or lifestyle compensation (24%).1 If employers can’t provide competitive benefits that meet Gen Z workers’ needs, especially at a time when many of them struggle with the cost of living, they’ll look elsewhere.

In attracting more mid-senior level talent, employers should keep millennial and Gen X workers’ non-negotiables in mind. Thirty-three percent (33%) of millennials say that they would not accept a job if health savings accounts (HSA/FSA) were not available and 25% say the same about life insurance support. For Gen X employees, 44% say additional compensation like bonuses and stock options would make or break a job offer and 26% would not take a job without a retirement plan.1

Of course, the most straightforward way to improve employees’ financial wellness is to simply pay them more. While raising wages is certainly a valid strategy for staying competitive in the labor market, small-to-medium-sized organizations may be limited in how much they can invest, no doubt already their highest expenditure. Creating a balance between compensation, benefits and financial wellness programs is key to retaining and recruiting talent.

Encourage financial wellness benefits

As the financial pressures on workers of all generations continue to grow – whether due to student loan debt, rising living and healthcare costs, or financial instability – small employers are expected to offer more financial wellness support in 2025. These benefits not only support employees’ financial health but they can also reduce stress, increase productivity, and improve overall job satisfaction.

The ADP TotalSource Retirement Savings Plan (the “Plan”) provides your employees with access to financial planning tools, workshops and retirement advisory services. Offering guidance on retirement savings, budgeting, and debt management can empower employees to make better financial decisions.

- myOrangeMoney® web experience – myOrangeMoney is an educational, interactive online experience2 that shows your employees how their current retirement savings may translate into monthly retirement income. It shows where they stand today, highlights areas that need improvement, and lets them take immediate action to improve their retirement readiness. Orange Money is the money needed to save for retirement, versus green money, which can be spent now. This back-to-basics approach helps your employees see the steps needed so they can take control of their finances.

- Financial Wellness experience – The experience, offered through the Plan, helps your employees reach their goals by focusing on six pillars of financial wellness. On the Plan’s participant website, employees can access a simple, quick assessment – it’s only 12 questions that takes less than 5 minutes to complete. It will help organize financial priorities in a meaningful way, help them with planning, and provide a practical framework for managing their financial life.

- Educational offerings give your employees the information they need to navigate their finances and make smart decisions about their future. Through workshops or webinars, Voya provides content that addresses both your Plan – features, benefits, investments – as well as holistic financial planning topics such as budgeting, personal finance, and nearing retirement. Education specialists3 are securities licensed, bilingual (English/Spanish) and located throughout the U.S. Additionally, employees have access to Voya Learn for live and on demand education sessions on a variety of financial wellness topics.

- Retirement advisory services – As employees plan to get back on track, they may benefit from a little more guidance. The Plan provides employees access to investment advisory services through Voya Retirement Advisors (VRA), powered by Edelman Financial Engines4.

- Online advice – a web-based service that lets employees get personalized retirement income forecasts5, risk assessments, specific savings and fund recommendations at no additional cost.

- Professional management –employees receive a personalized retirement savings and investment strategy, as well as ongoing monitoring and management of their Plan account by VRA investment advisor representatives. Delivery of this service does require a monthly fee.

As employers plan for the year and face an uncertain economic road ahead, the goal is clear: to foster a financially fit and literate workforce that feels supported and valued, benefiting both individuals and the organization.

-

2024 Employee Financial Wellness Report, Payroll Integrations

-

IMPORTANT: The illustrations or other information generated by the calculators are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified professional legal, financial and/or tax professional when making decisions related to your individual tax situation.

-

Education Specialists are registered representatives of Voya Financial Partners, LLC (VFP), member SIPC. VFP is a member of the Voya family of companies.

-

Advisory Services provided by Voya Retirement Advisors, LLC (VRA). Advisory Services are offered through VRA and are not sponsored or endorsed by ADP TotalSource or the ADP TotalSource® Retirement Savings Plan. VRA is a member of the Voya Financial (Voya) family of companies. For more information, please read the Voya Retirement Advisors Disclosure Statement, Advisory Services Agreement and your plan’s Fact Sheet. These documents may be viewed online by accessing the advisory services link(s) through your plan’s website at adptotalsource.voya.com. You may also request these from a VRA Investment Advisor Representative by calling your plan’s information line at (855) 646-7549. Financial Engines Advisors L.L.C. (FEA) acts as a sub advisor for Voya Retirement Advisors, LLC. Financial Engines Advisors L.L.C. (FEA) is a federally registered investment advisor. Neither VRA nor FEA provides tax or legal advice. If you need tax advice, consult your accountant or if you need legal advice consult your lawyer. Future results are not guaranteed by VRA, FEA or any other party and past performance is no guarantee of future results. Edelman Financial Engines® is a registered trademark of Edelman Financial Engines, LLC. All other marks are the exclusive property of their respective owners. FEA and Edelman Financial Engines, LLC are not members of the Voya family of companies. ©2025 Edelman Financial Engines, LLC. Used with permission.

-

IMPORTANT: Forecasts, projected outcomes or other information generated regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. In addition, results may vary each time a forecast is generated for you.