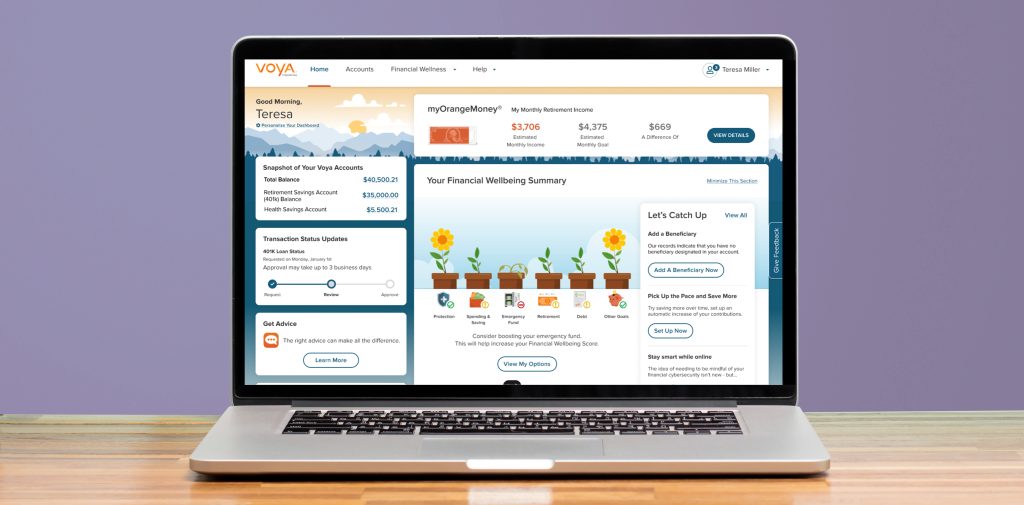

Let’s face it. Most people love money, just not managing it. So Voya set out to change the way participants experience their retirement plan account. Voya’s innovative spirit is driven by technology, human-centered design and deeper integration to help improve outcomes for your worksite employees. Participants can now bring their whole financial life together with the same account access in one private, cybersafe place with a little more to explore.

These enhancements to the participant experience are based on consumer sentiment, user feedback, market research and other insights. The enhancements align to Voya’s vision for individuals – aspiring to clear their path to financial confidence and a more fulfilling life. Specifically, Voya wants to help individuals understand their full financial picture in one comprehensive place and provide tools and resources to help them achieve their goals.

Here’s what your participants will enjoy:

Comprehensive and cybersafe

- Securely connect external accounts like checking, credit cards, savings and more alongside their ADP TotalSource Retirement Savings Plan (the “Plan”) account to get a full view of their net worth. Participants will receive personalized insights designed to help them improve their finances all in one cybersafe place.

All-inclusive and insightful

- Quick access to educational resources and interactive tools that can help them set goals, track their progress and get real-time insights on their money habits. Plus, the experience will adjust as their needs change to help them understand where they stand financially and manage their money with confidence.

Evolved experience

- Whether they want to check their Plan account balance, save more for their future, update their investments or even track progress on their goals, they can enjoy an effortless Voya account experience that adjusts with them.

Participants in the Plan will experience the new dashboard at the end of January, 2024.