Voya is committed to developing and delivering the type of leading technology that supports the success of the ADP TotalSource Retirement Savings Plan (the “Plan”) and its participants. Our technology, coupled with personalized services, create a Plan that is easier to administer and easier for participants to benefit from.

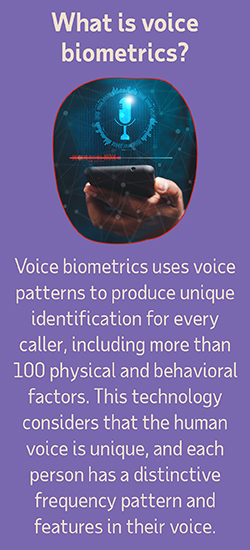

Voya Voiceprint

Voya Voiceprint makes it easier for your participants to get help and adds another layer of fraud-prevention to protect them. By comparing a participant’s voice to a recording of their voice from a previous interaction, Voya is able to confirm their identity. Here’s how your participants can set up Voya Voiceprint:

- Participant calls the Plan Service Center at (855) 646-7549.

- Participant uses their PIN to authenticate identity.

- Service Center Associate speaks to participant and helps them.

- Voya collects 30-60 seconds of speech from the caller.

- Voice biometrics technology analyzes voice patterns.

- Includes more than 100 physical and behavioral factors based on voice patterns.

- Participant is given the option to set up enrollment.

- Service Center Associate gives the participant the option to enroll in Voya Voiceprint.

- Voya Voiceprint will then be used to confirm the participant’s identity in subsequent calls to Voya.

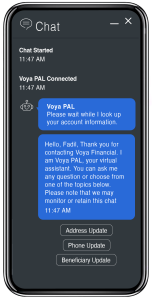

Voya PAL

Voya brought a conversational digital assistance experience to life with an intelligent Voya Personal Assistant Liaison – or Voya PAL for short – that assists participants similar to the way a live agent would, but with 24/7 availability that can serve them at all hours of the day or night.

“As the retirement industry continues to advance its use of digital technology, providing a continuous expansion of solutions for our customers is critical,” said Heather Lavallee, president and CEO, Voya Financial. “At Voya, we are continuously optimizing and expanding our suite of digital solutions to support our customers when, where and how they need it. As we continue to build upon the customer experience with new capabilities, the launch of Voya PAL has provided a great opportunity for us to leverage the latest advancements in technology to not only elevate the customer experience but, ultimately, help drive better outcomes as a result.”

With advancements in conversational artificial intelligence (AI), the use of digital assistants and chatbots in various industries, including financial services, continues to increase. Offering 24/7, fast and efficient information, chatbots use AI to hold real-time conversations with customers, enhancing the customer experience by providing convenient and direct engagement with individuals.

Here’s how it works:

Voya PAL’s capabilities include leveraging real-time AI that enables the chatbot to quickly understand participant intent and provide an easy, intuitive interaction experience to them. Specifically, plan participants are offered a pre-login chat experience that serves as an efficient digital interaction. Participants who have authenticated on the ADP TotalSource Retirement Savings Plan (the “Plan”) website can utilize the chatbot to make changes and get assistance with certain transactions — similar to their experience with live agents over the phone or in chat.

Behind the scenes and throughout the chatbot functionality, Voya PAL documents information that a Plan Service Center Associate might need to help resolve a participant’s inquiry. So when directed to a live Plan Service Center Associate, the entire chat history follows them for a warm handoff and better customer experience within the Plan Service Center.

“Voya is committed to investing in the latest digital technologies as a way to distinguish our customer experience from all others,” said Santhosh Keshavan, EVP and chief information officer, Voya Financial. “We continually work to anticipate and identify opportunities to leverage digital platforms to provide experiences that reflect the specific needs of our customers. Voya PAL offers yet another alternative for individuals to seek answers to their questions and find resolution to their needs — and as more customers engage with our digital assistant, Voya PAL is using AI capabilities to consume more data, learn more scenarios and become even more in tune to customer needs.”

Voya PAL builds on the company’s continued focus and investment in digital solutions that help improve the financial outcomes of all individuals.