Ms. Smith is an ADP TotalSource Retirement Savings participant who is single.

Ms. Smith looked at different saving scenarios with respect to the annual income she estimated she may need in retirement. She expects to retire at age 70 and wants to ensure she has retirement income for at least 30 years.

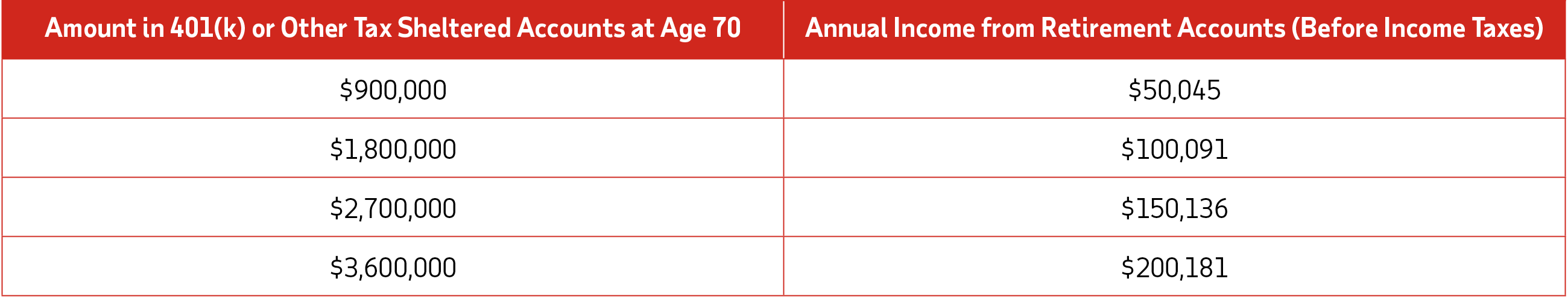

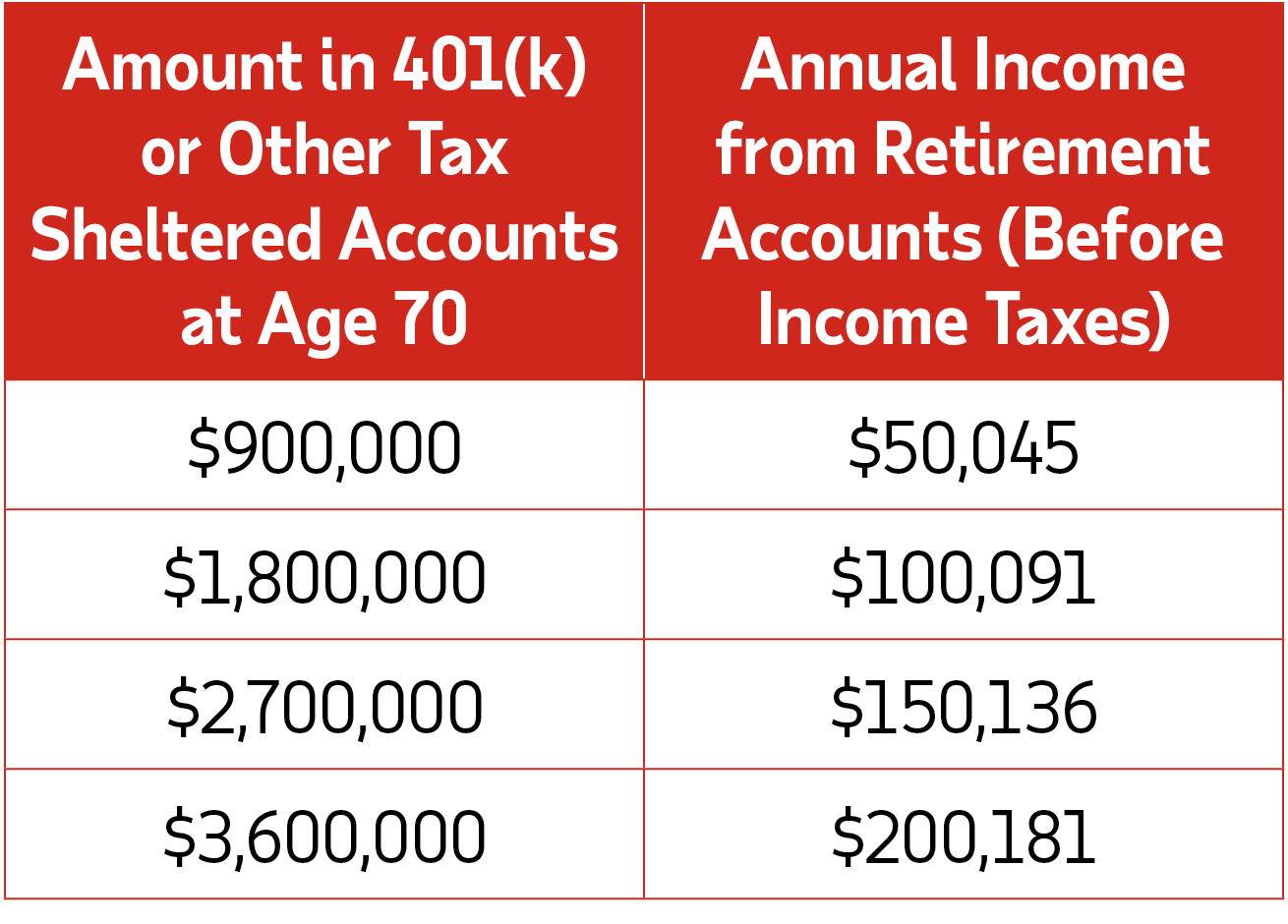

The following chart shows how much money Ms. Smith will need to have in her 401(k) Plan or other tax-sheltered accounts at age 70 and the annual income, before taxes, she can expect to receive from those accounts for 30 years.

Assumptions: This example assumes a 4% hypothetical rate of return, compounded annually and that the individual is single. This illustration is hypothetical, is not guaranteed, and is not intended to reflect the performance of any specific investment. It does not account for taxes due upon withdrawal. Actual results will depend upon when you start saving, the number of years you invest in retirement savings, the returns of your actual investments, and other factors.

The information contained on this website is intended to summarize at a high level some of the provisions under the ADP TotalSource Retirement Savings Plan (the “Plan”). It is not intended to provide a full description of the Plan. In the event of a conflict between the official Plan document and this website, the official Plan document is controlling.

Plan administrative services provided by Voya Institutional Plan Services, LLC (VIPS), a member of the Voya® family of companies.

ADP, the ADP logo, ADP TotalSource and Always Designing for People are trademarks of ADP, Inc. Copyright © 2023 All rights reserved.

© 2023 Voya Services Company. All rights reserved.